colorado solar tax credit 2019

With the coming reduction in the 30 tax credit 2019 is on pace to be a record setter for solar and we are already beginning to see an increase in demand here at Namasté Solar. For systems greater than 10kW the rebate is valued at 1 per MWh and paid every six months.

The Fascinating Mysterious Science Of Combining Farms And Solar Panels

Solar panel systems 10kW or smaller can receive a one-time upfront payment of 16 per kW.

. However you may only be eligible for a 22 tax credit if you do that anytime between January 01 and December 31 2023. If you install your photovoltaic system in 2020 the federal tax credit is 26 of the cost of your solar panel system. Keep in mind that the ITC applies only to those who buy their PV system outright either with a cash purchase or solar loan and that you must have enough income for the tax credit be meaningful.

When filing for a prior year be sure to only use the versions of forms that apply to that tax year including forms for tax credits and subtractions. 12720 Approximate system cost in Colorado after the 26 ITC in 2021. Additionally prior year forms cannot be used for the current tax year.

If you want to make sure you get the full 30 tax credit dont wait we expect 2019 installation schedules to fill up quickly. State tax expenditures include individual and corporate income tax credits deductions and exemptions and sales and use tax exemptions. The combined effect of the these laws provides up to a 30 tax credit on both the purchase and installation of qualifying products in renewable technologies such as solar electric property residential solar water heating qualified small wind energy and qualified geothermal heat pump energy among others.

Colorado Solar Incentive. 2019 is the Year to Go Solar. Dont forget about federal solar incentives.

Section 39-3-1187 CRS exempts from the levy and collection of property taxes the percentage of alternating current electricity capacity of a community solar garden that is attributed to residential or governmental subscribers or to subscribers that are organizations that have been granted property tax exemptions pursuant to 39-3-106 to 39-3-1135 CRS. Installing renewable energy equipment in your home can qualify you for a credit. There is also a tax credit for businesses that go solar.

1 With the average cost to go solar in Colorado hovering around 20175 the typical credit is 5246. The federal tax credit falls to 22 at the end of 2022. Federal Solar Tax Credit ITC The federal tax credit is available statewide and provides a credit to your federal income tax in the amount of 26 of your total cost of going solar.

With the Investment Tax Credit ITC you can reduce the cost of your PV solar energy system by 26 percent. According to EnergySage Solar. If filing by paper visit the Credits Subtractions Forms page to download the forms andor schedules needed to file for the credits listed below.

Take advantage of HUNDREDS in additional savings on sustainable solar products. The forms listed below are only valid for the 2019 tax year. There is no cap on the solar panel tax credits value and it even extends from homeowners to commercial properties.

This tax credit which you can apply toward your 2019 income taxes. A 10 tax credit will remain for. In December 2020 Congress passed an extension of the ITC which provides a 26 tax credit for systems installed in 2020-2022 and 22 for systems installed in 2023.

The Federal Solar Tax Credit provides 30-22 savings on the entire cost of eligible home upgrades. SolarTech a San Diego based solar company that installs SunPower solar recently posted this helpful guide and video. Colorado Solar Tax Credit 2019 - All homeowners who install a solar panel system by the end of 2019 can still claim the full 30 credit but that amount drops to 26 in 2020.

2019 was the final year homeowners could take advantage of a 30 federal tax credit on residential solar power. For example if you are filing a return for 2018 you must include the credit forms for 2018 with your return. Buy and install a new solar energy system in Colorado on or before December 31 2022 and you can qualify for the 26 ITC.

Also known as the Incentive Tax Credit or Federal Solar Tax Credit it permits homeowners to deduct 30 percent of the cost of installing solar panels from ones federal taxes. The residential ITC drops to 22 in 2023 and ends in 2024. Systems installed before December 31 2019 were eligible for a 30 tax credit The tax credit expires starting in 2024 unless Congress renews it.

Renewable energy resources include solar wind geothermal. To be eligible systems had to be installed before January 1 2020. If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 26 5200.

What is the Solar Panel Tax Credit All About. This memorandum provides information on state tax expenditures for renewable energy resources. So if you invested in solar power last year congratulations.

In turbotax open your tax return. The system must be purchased via cash or loan and installed before 2020. Beginning in 2020 homeowners or business owners who choose to have solar installed or their home or commercial building can deduct 26 of the cost of the solar from federal taxes.

Buy and install new solar panels in Colorado in 2021 with or without battery storage and qualify for the 26 federal solar tax credit. Be sure to use the form for the same tax year for which you are filing. 6 Approximate average-sized 5-kilowatt kW system cost in Colorado.

Through the end of 2019 you can still deduct the full 30 of the cost of your solar system from your federal taxes. Homeowners and business owners who install a solar panel system or wind or hydroelectric technology are eligible for a rebate. This is 26 off the entire cost of the system including equipment labor and permitting.

Colorado Solar Incentives Five Things Residents Need To Know Ion Solar

Green Steel Bamboo Construction Bamboo Building Bamboo Structure

How The Solar Tax Credit Makes Renewable Energy Affordable

Pin On Solar Powered Businesses

Homesolarincentives On Twitter Escuela

Colorado Solar Incentives Five Things Residents Need To Know Ion Solar

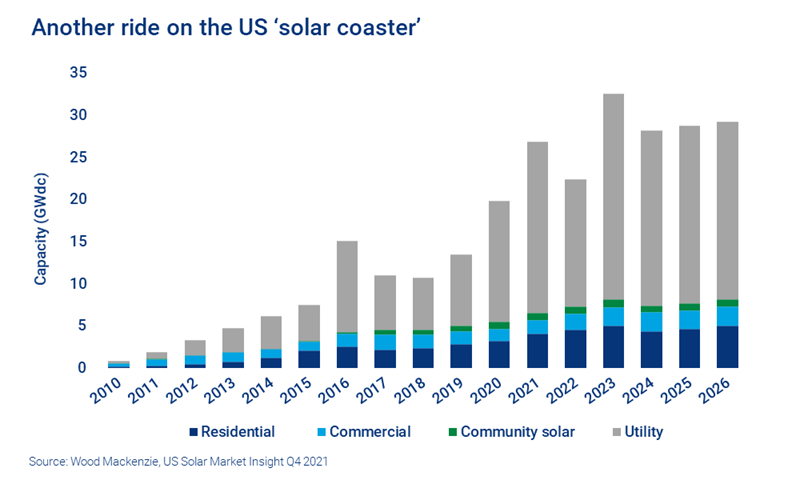

Redefining The Us Solar Coaster Wood Mackenzie

Pin On Solar Powered Businesses

Up To 90 Off On Solar Panel Installation At Find My Solar In 2022 House Design Modern House Solar House

How The Solar Tax Credit Makes Renewable Energy Affordable

Solartech Inc Solar Reviews Complaints Address Solar Panels Cost

Colorado Utility Sees Opportunistic Window With Solar Wind Storage Lắp đặt điện Mặt Trời Khải Minh Tech Http Thesunvn Com Vn 09 Colorado Solar Projects Solar

Are Solar Panels Worth It An Honest Opinion Uma Solar

How The Solar Tax Credit Makes Renewable Energy Affordable

Fake Five Star Reviews Being Bought And Sold Online Fake Five Star Reviews Being Bought And Sold Onl Online Reviews Custom Web Design Web Development Design

Solartech Inc Solar Reviews Complaints Address Solar Panels Cost

Fergus Electric Cooperative Fec In Lewistown Montana Selected Independent Power Systems In Bozeman To Install Their Firs Solar Solar Projects Solar Garden

7 Reasons You Are Not Using Your To Do List Show Me Your To Do List This Is A Request I Ask Those W To Do List Good Time Management Time Management