wake county nc sales tax breakdown

Historical Total General State Local and Transit Sales and Use Tax Rates. North Carolina Department of Revenue.

Homeowner Owners Could Be Pay More As Tax Hikes Are Proposed In Wake Raleigh Budgets Firefighters Rally For Pay Increase Abc11 Raleigh Durham

27511 27512 27513 27518 27519.

. The median sales price of a parcel of Wake County real estate for January 2022 faired at 410000 down only 1000 from December 2021s price of 411000. Wake County North Carolina has a maximum sales tax rate of 75 and an approximate population of 759583. The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc.

Wayfair Inc affect North Carolina. 828 rows 475 Average Sales Tax With Local. Did South Dakota v.

Wake Forest NC Sales Tax Rate The current total local sales tax rate in Wake Forest NC is 7250. Wake Forest is in the following zip codes. You can find more tax rates and allowances for Wake County and.

Form Gen 562 County and Transit Sales and Use Tax Rates for Cities and Towns Excel Sorted by 5-Digit Zip Historical County Sales and Use Tax Rates. The County sales tax rate is. The current total local sales tax rate in Cary NC is 7250.

The December 2020 total local sales tax rate was also 7250. Click here for a larger sales tax map or here for a sales tax table. Ad Find Out Sales Tax Rates For Free.

7 Sales and Use Tax Chart. PO Box 25000 Raleigh NC 27640-0640. The December 2020 total local sales tax rate was also 7250.

Apex NC Sales Tax Rate The current total local sales tax rate in Apex NC is 7250. The 2018 United States Supreme Court decision in South Dakota v. Ad New State Sales Tax Registration.

How to Compare Sales. There are a total of 460 local tax jurisdictions across the state collecting an average local tax of 222. Fast Easy Tax Solutions.

There is no applicable city tax. Sales Tax Breakdown Raleigh Details Raleigh NC is in Wake County. Has impacted many state nexus laws and sales tax collection requirements.

Historical County Sales and Use Tax Rates. 697 North Carolina has state sales tax of 475 and allows local governments to collect a local option sales tax of up to 275. The North Carolina sales tax rate is currently.

The minimum combined 2022 sales tax rate for Wake Forest North Carolina is. For tax rates in other cities see North Carolina sales taxes by city and county. Stress Free Hassle Free Sales Tax.

Most Populous Locations in Wake County North Carolina Raleigh. Click here for a PDF version of this table. 35 rows Sales and Use Tax Rates Effective October 1 2020 Listed below by county are the total 475 State rate plus applicable local rates sales and use tax rates in effect.

The Wake County sales tax rate is. The December 2020 total local. Get 1st Month Free.

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 725 in Wake County North Carolina. You can print a 725 sales tax table here. To calculate the sales tax amount for all other values use our sales tax calculator above.

The Wake Forest sales tax rate is. All numbers are rounded in the normal fashion. Individual income tax refund inquiries.

The 2018 United States Supreme Court decision in South Dakota v. Ad Put Your Sales Tax On Autopilot. Sales Tax Application Form information registration support.

Sales Tax Breakdown Wake Forest Details Wake Forest NC is in Wake County. The North Carolina state sales tax rate is currently 475. Cary is in the following zip codes.

Historical Total General State Local and Transit Sales and Use Tax Rates. If this rate has been updated locally please contact us and we will update the sales tax rate for Wake County North Carolina. Sales Tax Breakdown Cary Details Cary NC is in Wake County.

27601 27602 27603. Apex is in the following zip codes. Sales Tax Breakdown Apex Details Apex NC is in Wake County.

025 lower than the maximum sales tax in NC The 725 sales tax rate in Cary consists of 475 North Carolina state sales tax 2 Wake County sales tax and 05 Special tax. To review the rules in North Carolina visit our state-by-state guide. The sales tax rate for Wake County was updated for the 2020 tax year this is the current sales tax rate we are using in the Wake County North Carolina Sales Tax Comparison Calculator for 202223.

Sales and Use Tax Rates Total General State Local and Transit Rates County Rates Items Subject Only to the General 475 State Rate Local and Transit Rates do not Apply Items Subject to the 7 Combined General Rate Items Subject to a Miscellaneous Rate Sales and Use Taxes Imposed in Addition to the Rates Listed Above Other Information. The County sales tax rate is. Wake County NC Sales Tax Rate The current total local sales tax rate in Wake County NC is 7250.

Wake County in North Carolina has a tax rate of 725 for 2022 this includes the North Carolina Sales Tax Rate of 475 and Local Sales Tax Rates in Wake County totaling 25. North Carolina Department of Revenue. There is no applicable city tax.

The December 2020 total local sales tax rate was also 7250. Higher sales tax than 98 of North Carolina localities 025 lower than the maximum sales tax in NC The 725 sales tax rate in Raleigh consists of 475 North Carolina state sales tax 2 Wake County sales tax and 05 Special tax. PO Box 25000 Raleigh NC 27640-0640.

The current total local sales tax rate in Raleigh NC is 7250. Includes the 050 transit county sales and use tax. DAVO Sets Aside Files Pays Your Sales Tax On Time So You Can Focus On Your Business.

Has impacted many state nexus laws and sales tax collection requirements. The December 2020 total local sales tax rate was also 7250. Raleigh is in the following zip codes.

Sales tax rates in Wake County are determined by ten different tax jurisdictions Apex Fuquay-Varina Cary Garner Raleigh Knightdale Wake Forest Rolesville Zebulon and Durham Co Tr.

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Wake County Nc Property Tax Calculator Smartasset

How To Find Out If Your Wake County Property Tax Is Going Up Abc11 Raleigh Durham

North Carolina Sales And Use Tax Audit Guide

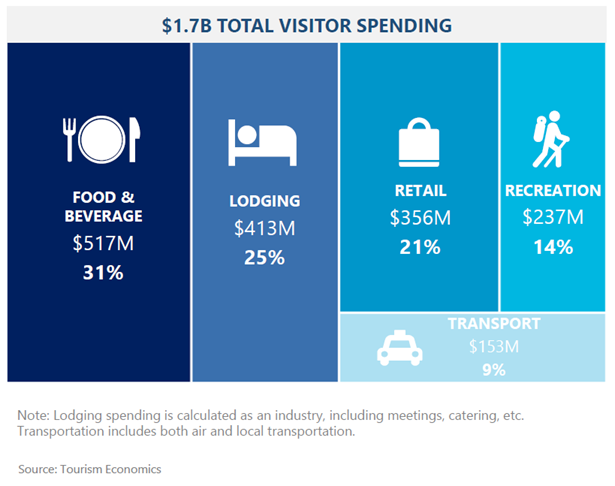

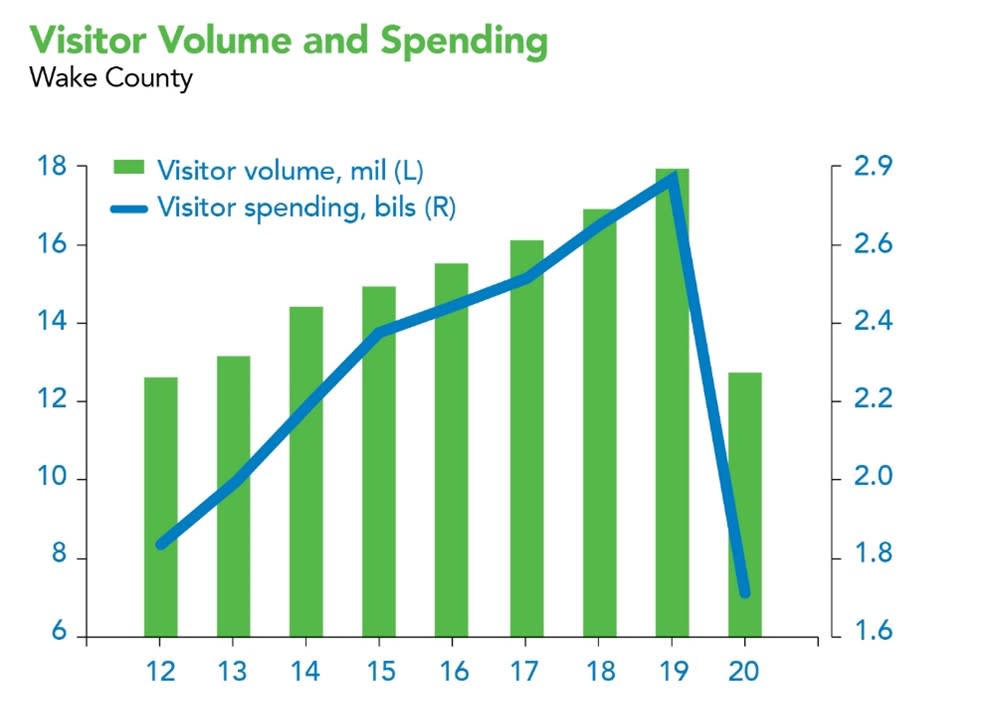

2020 Wake County Visitation Figures Released

2020 Wake County Visitation Figures Released

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Wake County North Carolina Nc Jobs Wake Employment Opportunities Directory

2020 Wake County Visitation Figures Released

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

North Carolina Sales Tax Rates By City County 2022

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Wake County Covid Cases Wake Forest Raleigh Cary Holly Springs Wral Com

Wake Votes To Raise School Meal Prices As Free Meals Will End Wral Com